For the first time since 2022, Australia’s central bank raises interest rates, citing persistent inflation and a robust labour market as key drivers behind the move.

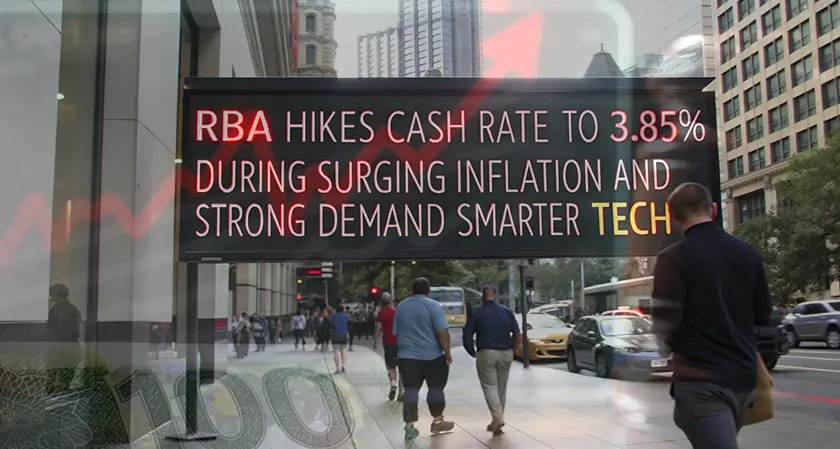

The Reserve Bank of Australia has increased its official cash interest rate for the first time since August 2022 due to increased inflation and a strong demand for goods and services domestically. On Tuesday, the RBA Board decided to raise its key cash rate from 3.6% to 3.85%, representing an increase of twenty-five basis points (bps).

It has been indicated that inflation has continually increased through the RBA's inflation target range of 2%-3%, prompting the Board to stop its last cycle of decreasing the cash rates and begin raising them, indicating tighter monetary policies.

Despite the fact that this is likely to significantly increase the cost of borrowing for consumers, especially homeowners with mortgages, RBA Governor Michele Bullock has indicated that the increase is necessary. Citing the fact that the trimmed mean, RBA's preferred measure of underlying inflation, is currently at an unsustainably high level, Bullock understands the burden that this is likely to cause to many, and affirms that the increase is appropriate in the broader context of the economy.

The decision to raise interest rates was made based upon historical data indicating that there was an unexpectedly strong labour market and inflationary pressure performance, particularly through 2025. Moreover, while the unemployment rate continues to be close to record lows, prices have been under significant pressure from both the purchase of goods and the purchase of services.