Home Innovation Networking BlackRock launched its first T...

BlackRock launched its first Tokenized Fund, BUIDL, on the Ethereum Network

Networking

Business Fortune

25 March, 2024

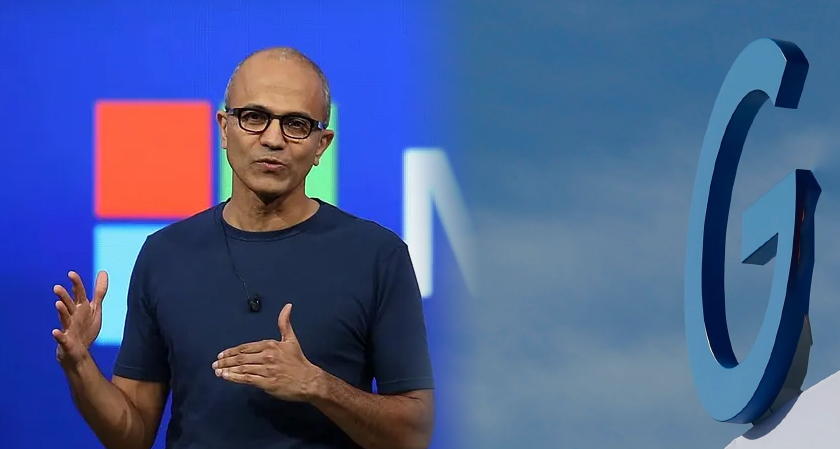

BlackRock invested in Securitize to drive transformation for digital assets infrastructure

BlackRock has introduced its inaugural tokenized fund on a public blockchain, unveiling the BlackRock USD Institutional Digital Liquidity Fund, referred to as "BUIDL" or the "Fund." Qualified investors can now access U.S. dollar yields by subscribing to the fund through Securitize Markets, LLC. Tokenization remains a central component of BlackRock’s digital asset strategy. Through the tokenization of the Fund, BUIDL aims to provide investors with various benefits, including facilitating the issuance and trading of ownership on a blockchain, enhancing investor access to on-chain offerings, enabling transparent and immediate settlement, and supporting transfers across platforms. BNY Mellon will facilitate interoperability for the Fund between digital and traditional markets.

BlackRock Financial Management, Inc., will oversee the fund's investment management, while Bank of New York Mellon will serve as the custodian and administrator. Securitize will act as a transfer agent and tokenization platform, managing tokenized shares and reporting on fund activities. Securitize Markets will serve as a placement agent for eligible investors. PricewaterhouseCoopers LLP has been appointed as the fund's auditor until December 31, 2024. The Fund will issue shares under Rule 506(c) of the Securities Act of 1933 and Section 3(c)(7) of the Investment Company Act, with an initial investment minimum of $5 million. BlackRock has also made a strategic investment in Securitize, with Joseph Chalom, BlackRock’s Global Head of Strategic Ecosystem Partnerships, joining Securitize’s Board of Directors as part of the investment agreement.